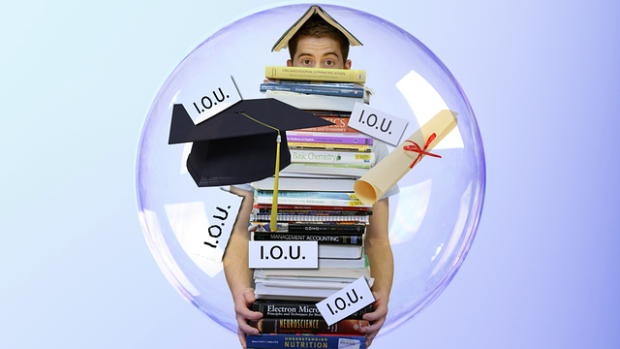

Don’t Let Student Debt Hold Back Your Career, Why You Should Refinance Before Rates Rise

For millennials especially, carrying a large amount of student debt can be worrisome. You spent years getting an education only to find limited opportunities to make headway with your career. And you certainly didn’t find that your earnings were what you’d hoped for. What do you do with that student debt, especially in light of rising interest rates?

Right now, interest rates are still historically low. But with multiple student loans, even those low rates can add up. Plus, if you never took advantage of post-graduate opportunities to refinance the debt and get better rates, you’re paying more than you should be.

What are your options? Here’s a summary.

Student Loan Refinancing

Refinancing a student loan is similar to any other debt refinancing in that you’re trading an old loan for a new one. One of the motivations for doing that is to achieve a lower interest rate. And the lower interest rate means that you’re paying the bank less interest, paying off the loan more quickly, or a combination of both. The bottom line: You save money.

Alternatively, your objective may be to lower payments rather that have a focus on the money saved with lower interest. That’s a valid reason to refinance, also, especially if your income has been less than expected. The lower payments can relieve the financial pressure of a tight budget, and let you focus more on your career.

Student Loan Consolidation

Many students leave college with a number of separate loans, each with different rates and terms. A consolidation loan is a type of refinance that bundles most or all of your student debts into a single loan. One payment, instead of several. One interest rate. So it’s easier to see exactly what you owe and the progress you’re making.

With either a straight refinance or a consolidation loan, you’ll want to consider all the factors so you can make a sound financial decision. There are several online questionnaires and calculators to help you analyze your options. You should take a serious look at this, because rates are going up and right now you can get rates as low as just over 2 percent.

Keep Control By Active Management

Debt of any kind is never a “set it and forget it” thing. You’ll always want to be aware of changing interest rates, government programs, and of course your own debt obligations. With diligence and patience, that huge chain of debt you feel around your ankle will be off before you know it.

.

Images via pixabay.