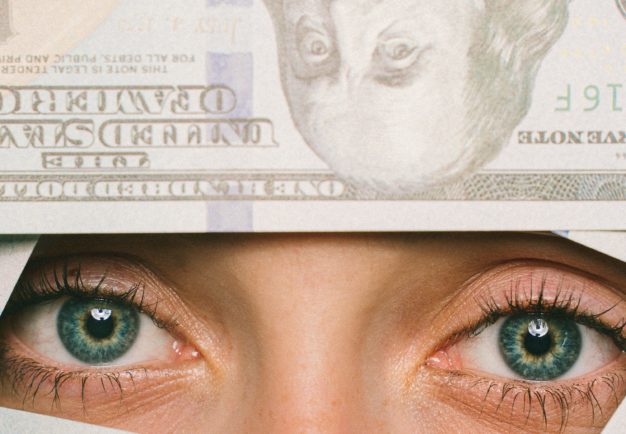

It’s Your Money Too! Get Active About Your Finances

Money. Investing, Financial Planning. For many women, these are cringe-worthy words. Overt and subtle cultural messages teach us not to worry ‘our pretty little heads’ about it. (Do you hate that phrase too?). It might feel good in the short term, but it’s just plain stupid in the long term.

59% of widowed or divorced women wish they had been move involved in long-term financial decisions. Don’t be one of them!

A recent UBS survey showed that while women in relationships might look after the daily bills, they still tend to leave longer term planning to their (male) partners. When the worst happens, they’re stuck. Don’t let this happen to you.

Let’s Talk About Money, Honey

Talking about money can be uncomfortable. Do it anyway. Start with one conversation, then turn it into a regular discussion topic. Many people set aside a particular time, once or even twice a year. I call it ‘Finance Day.’ It starts with the financial discussion about goals and gaps, moves on to solutions and commitments, and ends with a glass of wine. Not confident about getting started? Get advice here…

Share and Share Alike

Whatever you and your partner agree about money, you must agree to share the information equally. You must know where all of the bank accounts, credit cards, investments, and life insurance plans are. Same for 401Ks and pensions. Watch them all carefully, and watch your credit rating. If you have joint accounts, his financial missteps can affect your credit rating too. Don’t let his mistakes drag you down, just because the conversations are awkward.

61% of Millenial women let their spouse make the financial decisions

Be Financially Curious

Even if you leave the primary responsibility for long-term plans with your partner, be educated and involved. Know your financial advisor. Choose one who talks with both of you equally; don’t let yourself be ‘wallflowered’ and left out of the conversation. And if they use terms you don’t understand, ask for an explanation. Just say ‘Tell me more about that’ or ‘I am not familiar with that.’ If they refuse to explain, find another advisor.

The Payoffs: More than Money

88% of women agree that making shared financial decisions gives them more confidence in their financial future

Direct involvement in your financial future gives you control and confidence. Honesty and openness can bring you closer together with your partner. There are even reports that women are more successful investors than men. And if the worst happens and you find yourself alone, you will be far better prepared.