Gain control of Debt Now

Tired of being in debt? Ready to gain control of debt starting right now? Most people are, but they lack clarity on what they can do to stop the debt cycle. Read on for six tips to get started!

Tip #1: Know how much is earned and spent every month

- Use debit card for all spending to keep track.

- Cut any and all unnecessary spending.

Tip #2: Determine how much is really left over to repay loans and debts

After necessities like food and housing, how much is really available to repay debts?

Tip #3: Start with the highest interest rate debt

Credit cards may be the highest interest rate offenders–an average 19.1 percent APR!

- Negotiate a lower interest rate with the lender. Propose more favourable financial terms in writing.

- If credit card debt represents the bulk of what’s owed, consider transfer of debt from one or two cards to a new zero-interest card.

- Consolidate all debts into one loan to lower monthly payments owed.

- Lock-in a lower mortgage rate to free up more funds each month.

- Use asset-backed loans, such as those requiring collateral (home or auto), with care.

Tip #4: Free up additional cash

In order to make more than minimum payments, consider sale of significant assets, e.g. automobile, jewellery, etc.:

- Consider a loan from an insurance policy.

- Request a loan from family if possible.

Tip #5: Avoid new financial traps

Compare all new loans carefully, including origination fees, interest rates, and terms:

- Avoid payday lenders (and all super-short-term lenders)–rates can exceed hundreds to thousands of percent of principal!

- Avoid so-called financial advisers or money managers who charge fees for debt counseling assistance.

Tip #6: Visit a no-cost debt counselor service

Citizens Advice or Consumer Credit Counseling Service help to arrange a monthly budget and propose more favourable repayment terms to creditors.

And here’s some more insights:

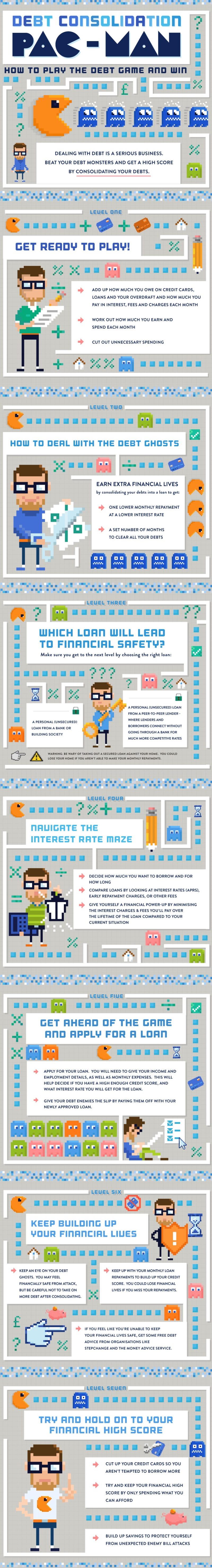

Don’t let the debt PACMAN eat up your earnings and life. Photo Credit: Zopa.com

Don’t let the debt PACMAN eat up your earnings and life. Photo Credit: Zopa.com