Starting Your First Job? 3 Personal Finance To-Dos

The following is a guest post from www.nerdwallet.com

Switching from paying for tuition and textbooks to watching your bank account grow with the income of your first real salary is an exciting milestone. But graduating and being on your own also means it’s time to start thinking about investing and saving the money you earn. The earlier you start both, the less financial pressure you’re likely to feel later in life.

Not sure where to start? Here are three personal finance tasks to tackle as soon as possible.

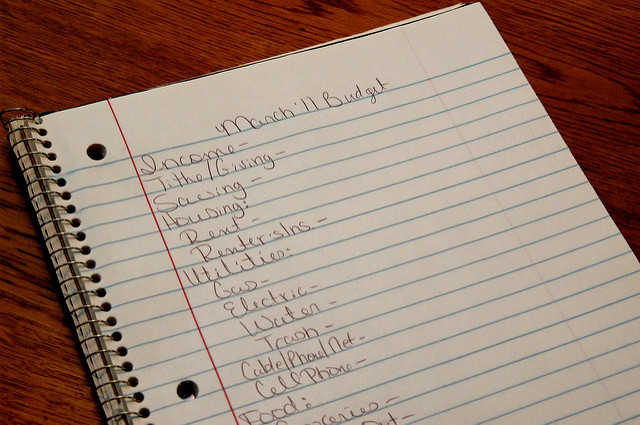

Create a budget

Unless you’re entering a high-paying field, your income right out of school might be a bit, let’s say, modest. The best way to live comfortably on an entry-level salary is to create — and stick to — a budget. That word may be intimidating, but in its most basic form, a budget simply outlines all of your money going in and out, and it helps you ensure you don’t spend more than you earn. A budget can certainly include fun discretionary items like dining out or clothes shopping — it just sets limits on how much you can afford to spend in each category.

If you have any monthly debt payments — like student loans, car loans or credit card bills — those should be factored into your budget. It’s also wise to set aside a little room in your budget for money to be saved in an emergency fund. Even socking away just $20 a month can make a difference over time and help prevent you from going into debt for unexpected expenses, like an iPhone that decides to take a swim in the toilet. When you’re ready to get started, try a free budgeting tool or create your own system in Google Sheets or Excel.

Start a retirement account

It may feel strange to start saving for retirement as soon as you graduate from college, especially if you have student loans you’re stressing about. But the earlier you start, the more you’ll save over time due to the beauty of compounding interest (this essentially means earning gains on your investing gains). Employers typically offer 401(k) retirement accounts, which allow you to contribute a percentage of your income before it’s taxed. In addition to the tax-free savings, this also lowers your annual IRS bill.

As soon as your employer allows it, open a 401(k) and start contributing as much as you can while staying within your budget. The percentage you contribute will be automatically deducted from your paycheck, so you don’t even have to think about it. Some employers also offer a match up to a certain amount, typically 3% to 6% of your salary. But you have to contribute at least that much of your income to get the match. If you can afford to contribute enough to get at least some of the match, don’t hesitate — it’s free money that will help your retirement savings grow even faster. Investing when you are in your twenties rather than waiting until later gives you a major head start and helps prevent having to set aside a larger portion of your income later in life.

Explore investing

Contributing to a retirement account isn’t the only way to start investing and making your money work for you. If you have any spare money left at the end of the month, or experience a windfall like a tax return or birthday gift, consider stashing some of it in non-retirement investments.

A popular investment option, exchange-traded funds, are similar to mutual funds in that they’re a bundle of various investments that can grow and earn you more money over time. ETFs tend to have lower fees and smaller minimum investment requirements than mutual funds. That makes them a good entry-level investment vehicle.

If you know next to nothing about investing or ETFs, don’t sweat it. Online brokers make it easy to purchase ETFs. And, most have tools that help you select the best funds to build your portfolio and many offer generous promotions to help you get started.

Remember, when you get started on your personal finances early, you are the one who will reap most of the long-term benefits!

Image Credits: